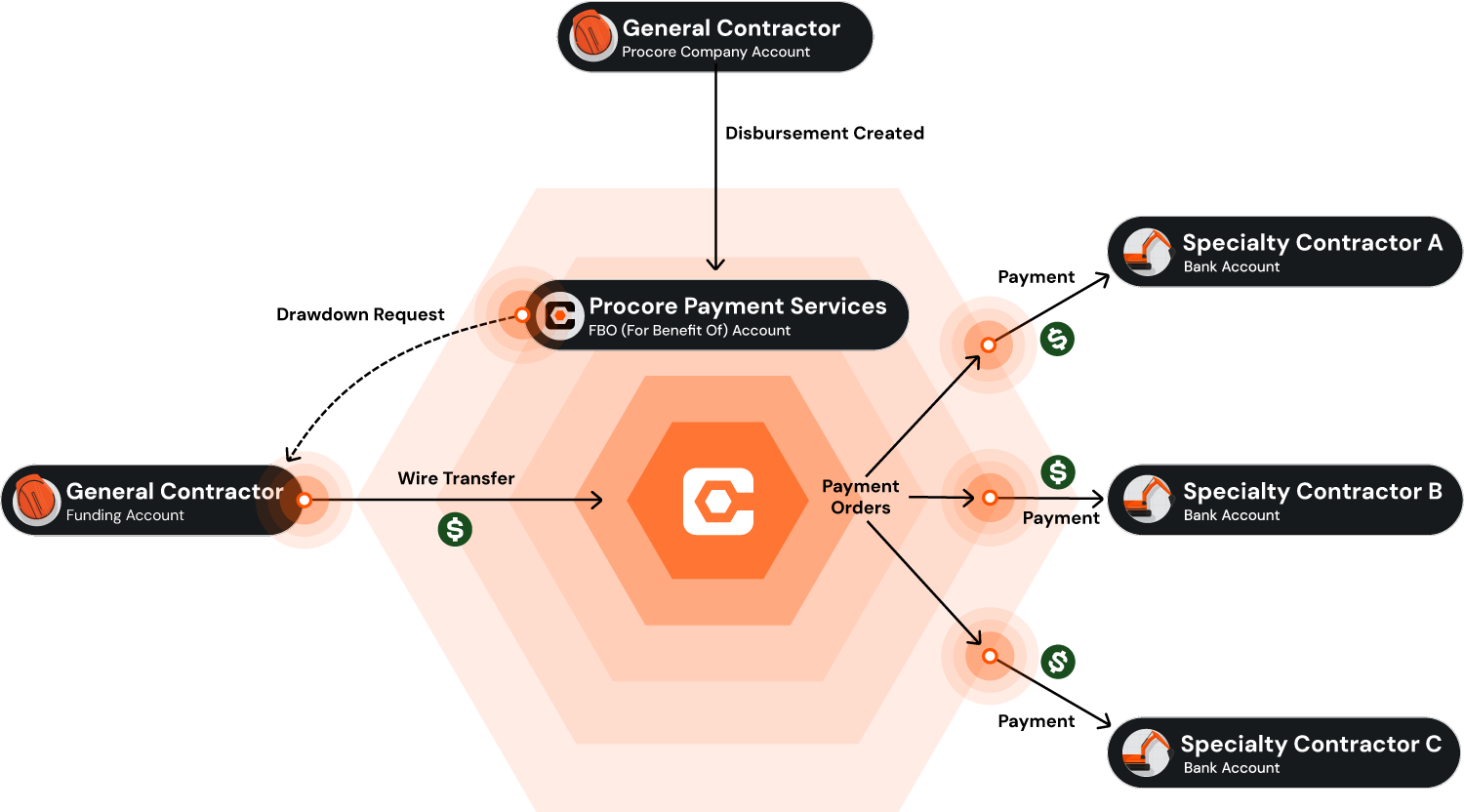

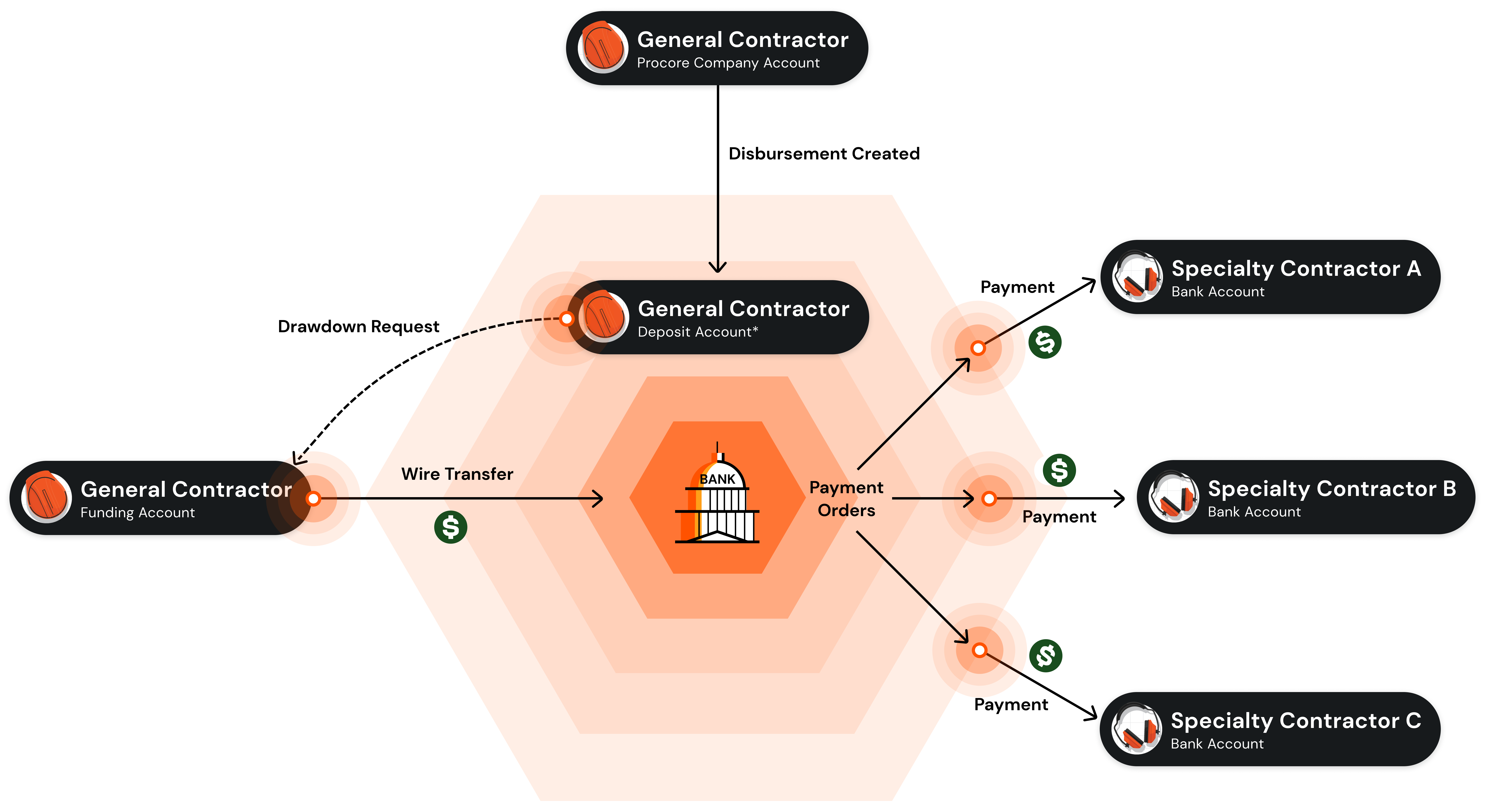

How do funds flow between bank accounts with Procore Pay?

General Availability in Select Markets (United States)

Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Answer

Only a In Procore Pay, a Payments Admin is a designated Procore user who administers the Company level Payments tool for that company's Procore account. Typically, one (1) or a small number of trusted users are designated to perform the tasks associated with this role. In Procore Pay, a Payments Disburser is a Procore user granted permission to create and view disbursements in the Company level Payments tool. Because of the sensitive nature of payments, only a Payments Admin can add/remove disbursers.

Procore Pay with Procore Payment Services, Inc.'s Money Transmission Services