Add a Goods & Services Tax (GST) to a Budget

Background

In numerous countries, a Goods & Services Tax (GST) is a tax that is applied to certain goods or services in that country. Depending on the country, it may also be referred to as a Value Added Tax (VAT). When this type of tax is levied by the government, businesses are responsible for collecting the tax on the required goods and services, as well as for remitting the taxes collected to the government.

Examples

The following examples are for illustrative purposes only:

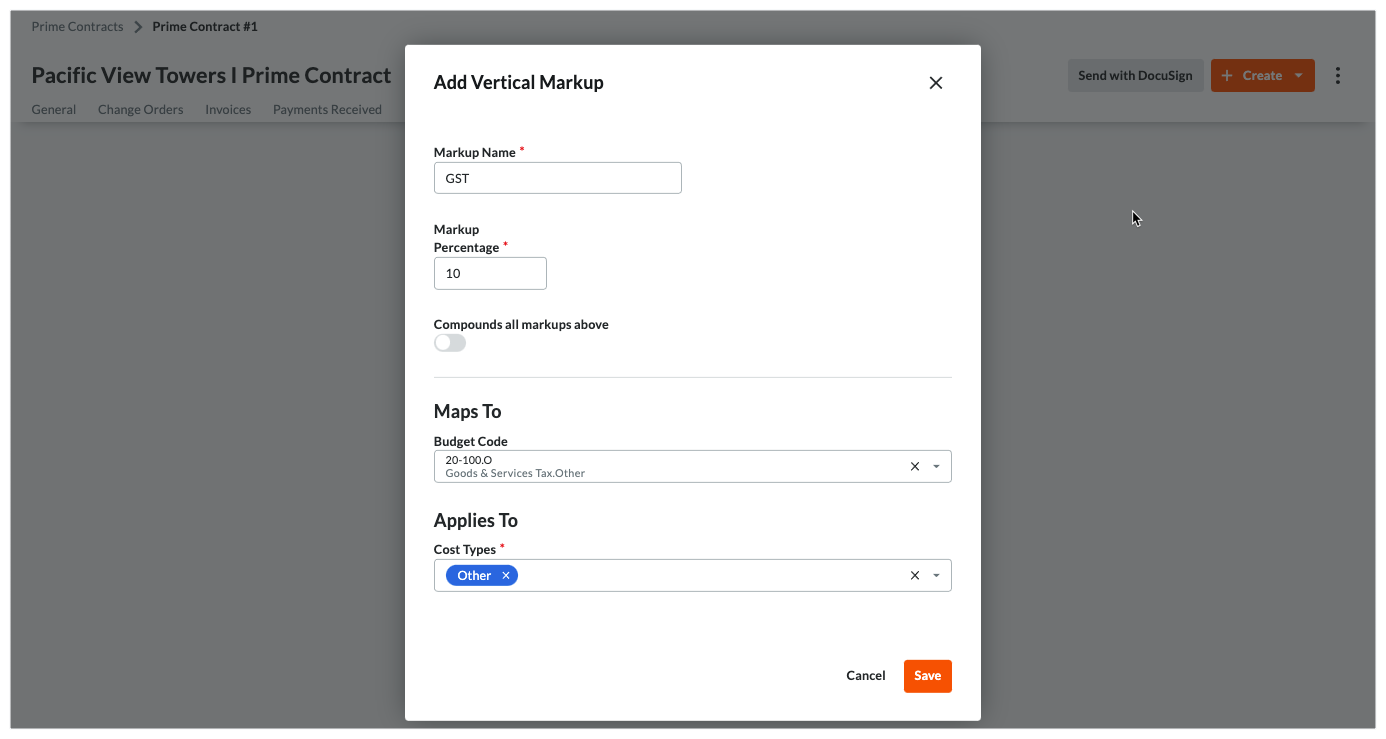

In Australia, the government levies a 10% tax is added to most goods and services, with some exemptions.

In Canada, the government levies 5% is added to taxable goods and services. Some provinces may also levy a separate Provincial State Tax (PST) on goods and services and/or combine the GST and PST into a single Harmonized Sales Tax (HST).

To determine your country's specific tax requirements, always consult your government tax authority.

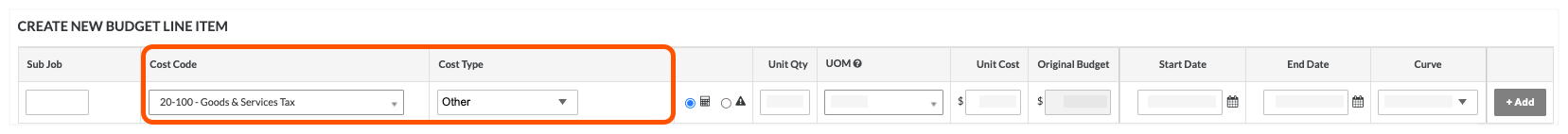

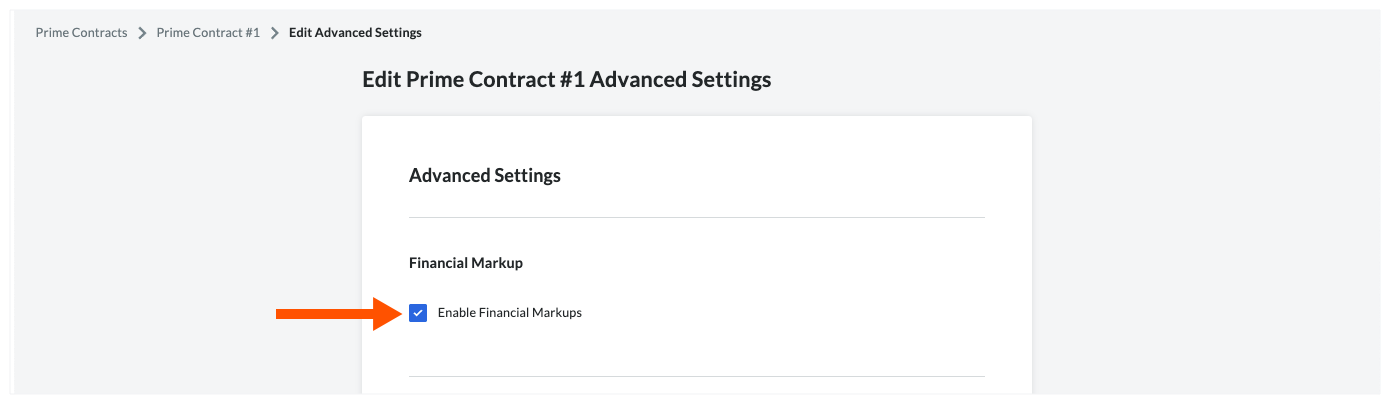

If you work in a country that requires your business to collect and remit this tax to the government, your company's Procore Administrator can create a dedicated cost code in the Company Admin tool at the company and project level. Your administrator can also choose to use the 'Other' cost type (or to create a custom cost type to associate with the GST tax cost code). Project users can then add financial line items with financial markup to associate with the cost code (and chosen cost type), so a GST line item displays on the project's payment applications (a.k.a., claim schedules) and progress claims (a.k.a., tax invoices).