Details

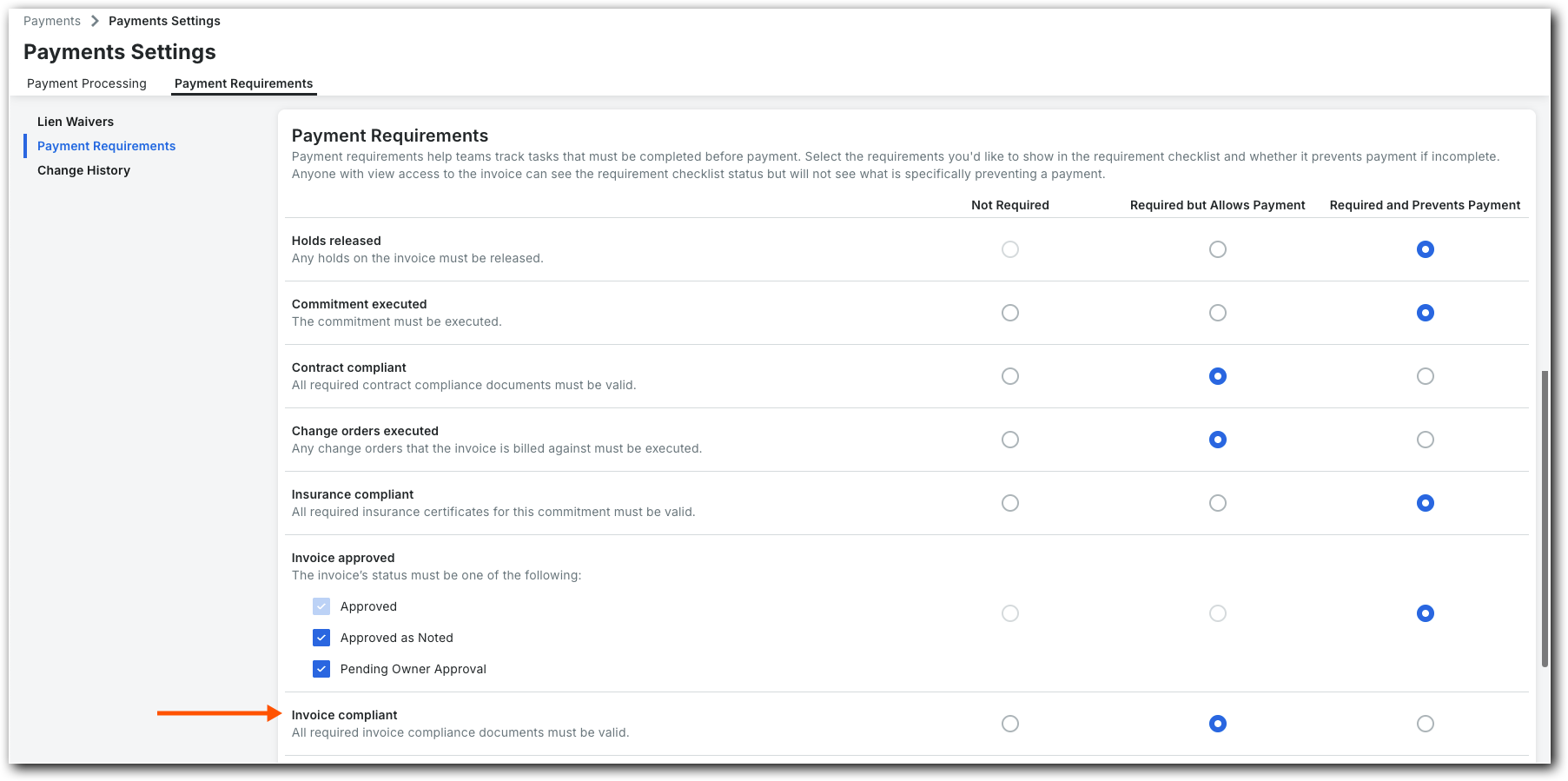

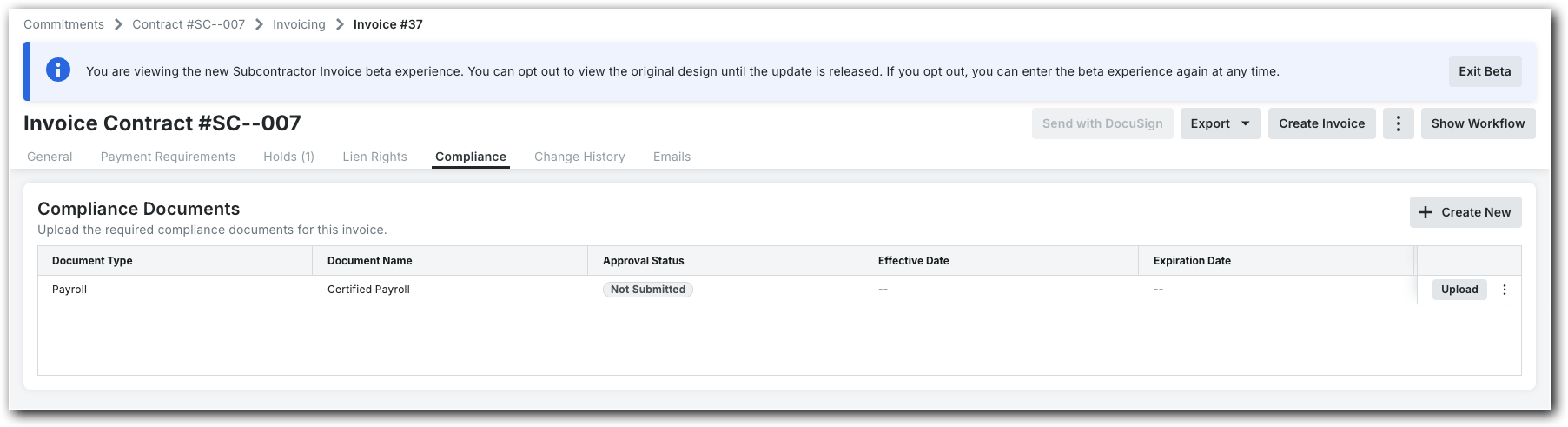

The Compliance tab on a subcontractor invoice in Procore Pay includes several key features designed to streamline the management of compliance documents during the invoice process.These features collectively help ensure that all compliance-related requirements are efficiently managed, reducing the risk of payment delays due to missing or incomplete documentation.

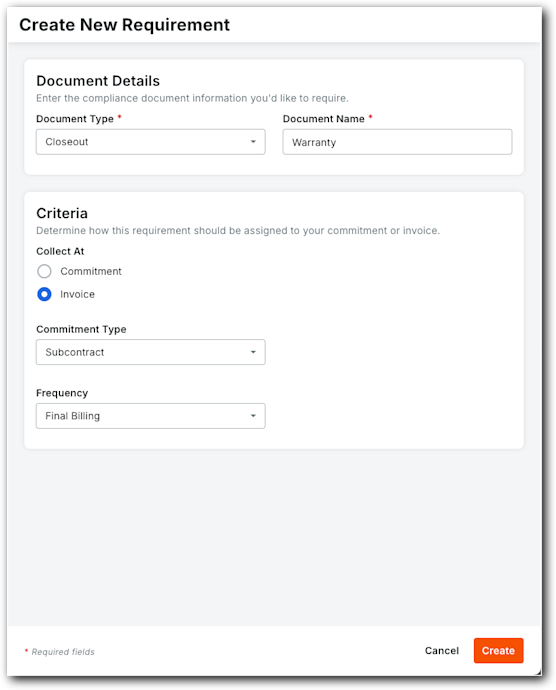

Collect Required Compliance Documents During Invoice Submission

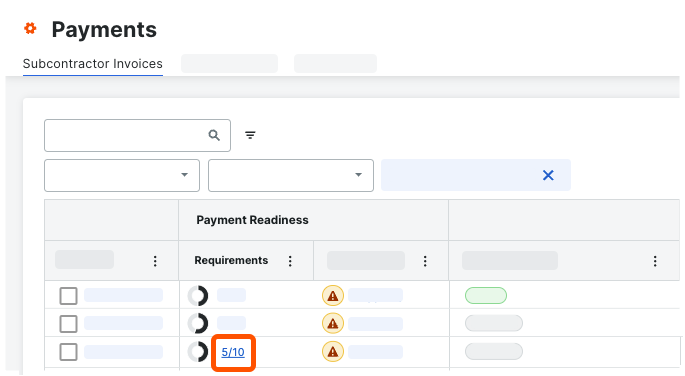

Payors can collect any required compliance documents from your payees during invoice submission. For example, collecting a W-9 is often contractually required for tax compliance and accurate record-keeping. Invoice administrators can perform these actions to ensure payment requirements are met and verified on project invoices from the Commitments or Invoicing tool. Payments Admins and Disbursers with invoice administrator permission can also verify the requirements before invoice approval and payment from the Payments tool. Invoice contacts may also be able to perform these actions with the payor's permission.

To learn more, see:

Examples

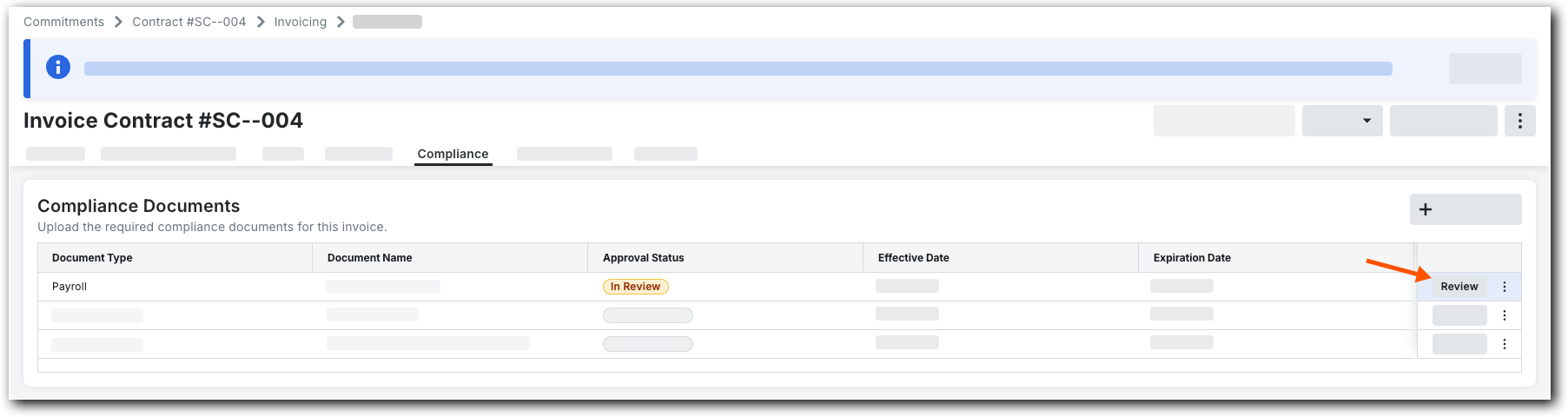

This shows you the Compliance tab on a subcontractor invoice.

Review Submitted Compliance Documents

Once the required compliance documents have been submitted, users with invoice administrator permissions on a project can manually add or remove compliance documents as needed. Note that any manual changes do not carry over to future invoices.

Example

This shows you the Review button on the Compliance Documents tab of a subcontractor invoice.