What fields are in an estimate and how are they calculated?

Fond

Après avoir ajouté des métrés pour le projet, vous pouvez afficher les estimations du projet, définir les coûts de main-d’œuvre et les marges bénéficiaires, et générer des propositions téléchargeables. Vous pouvez également saisir manuellement des informations sur une estimation sans métrés. Chaque section de la page Estimation affiche les éléments appropriés des propositions du projet, tels que la quantité et les coûts des matériaux, la main-d’œuvre et les coûts de main-d’œuvre, les inclusions et les exclusions, ainsi qu’un résumé général de la proposition. Voir

Réponse

Les données d’une estimation s’écoulent généralement de gauche à droite, puis dans la section récapitulative.

Il existe deux façons différentes d’afficher la main-d’œuvre dans une estimation.

Taux de main-d’œuvre individuel : lorsque vous utilisez des taux de main-d’œuvre, vous définissez le taux de main-d’œuvre comme coût par heure/minute, puis indiquez le nombre de minutes ou d’heures nécessaires. Vous pouvez également inclure un multiplicateur de « difficulté » qui indique le nombre de personnes nécessaires pour effectuer le travail.

Tarification au coût unitaire pour la main-d’œuvre - Lors de l’utilisation de la tarification au coût unitaire pour la main-d’œuvre, la main-d’œuvre est fixée à un taux forfaitaire. Il calcule la main-d’œuvre comme suit : Quantité x Coût de la main-d’œuvre.

En fonction de vos paramètres, vous verrez différents champs dans l’estimation.

Pointe

Le paramètre par défaut de l’affichage de la main-d’œuvre est configuré dans les paramètres de votre outil :

Outil de planification du tableau d’appels d’offres et du portefeuille - Configurer les paramètres du tableau d’appels d’offres

Outil Estimation - Configurer les paramètres par défaut de l’outil Estimation

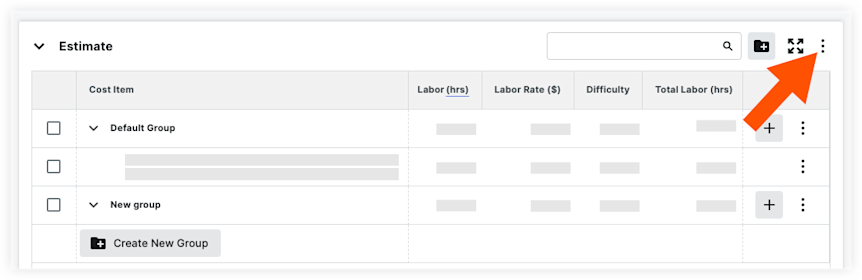

Vous pouvez également mettre à jour les paramètres d’un projet spécifique en cliquant sur les points de suspension verticaux ![]() pour l’estimation et en activant ou en

pour l’estimation et en activant ou en![]() désactivant le bouton « Utiliser la

désactivant le bouton « Utiliser la ![]() tarification au coût unitaire pour la main-d’œuvre ».

tarification au coût unitaire pour la main-d’œuvre ».

Column Name | Column Type | Override? | Description |

|---|---|---|---|

Labor Tax % | Standard | Yes | The percent at which to apply tax to labor. |

Labor Tax $ | Calculated | No | Labor Tax is equal to (Total Labor Sales + Overhead) x Labor Tax %. |

Material Tax % | Standard | Yes | The percent at which you want to apply tax to materials. |

Material Tax $ | Calculated | No | Material Tax is equal to Total Material Sales x Materials Tax %. |

[Other Taxes] | Based on what other cost types you have, you will see additional taxes. Other taxes is equal to Total [type] Sales x [type] Tax. | ||

Total Taxes | Calculated | No | Total Taxes is equal to Labor Tax + Material Tax + [Other Tax]. |

Autrui

Column Name | Column Type | Override? | Description |

|---|---|---|---|

Bonding | Standard | Yes | How much insurance percentage you pay based on Total Sales, Adjustments, and Taxes. Bonding is equal to (Total Sales + Total Adjustments + Taxes) x Bonding %. |

[Custom Adjustments] | Standard | Yes | Additional adjustments added. The amount is equal to (Total Sales + Total Adjustments+ Taxes) x [Custom Adjustment %]. |

Total Other | Calculated | No | Total Others is equal to the sum of all adjustment amounts in this section. |

Total

Column Name | Column Type | Override? | Description |

|---|---|---|---|

Total | Calculated | No | The Total Sales Price + Total Adjustments + Total Taxes + Total Other. |