Ajouter une taxe sur les produits et services (TPS) à un budget

Fond

Dans de nombreux pays, une taxe sur les produits et services (TPS) est appliquée à certains biens ou services dans ce pays. Selon le pays, elle peut également être appelée taxe sur la valeur ajoutée (TVA). Lorsque ce type de taxe est prélevé par le gouvernement, les entreprises sont responsables de la perception de la taxe sur les biens et services requis, ainsi que du versement des taxes perçues au gouvernement.

Examples

The following examples are for illustrative purposes only:

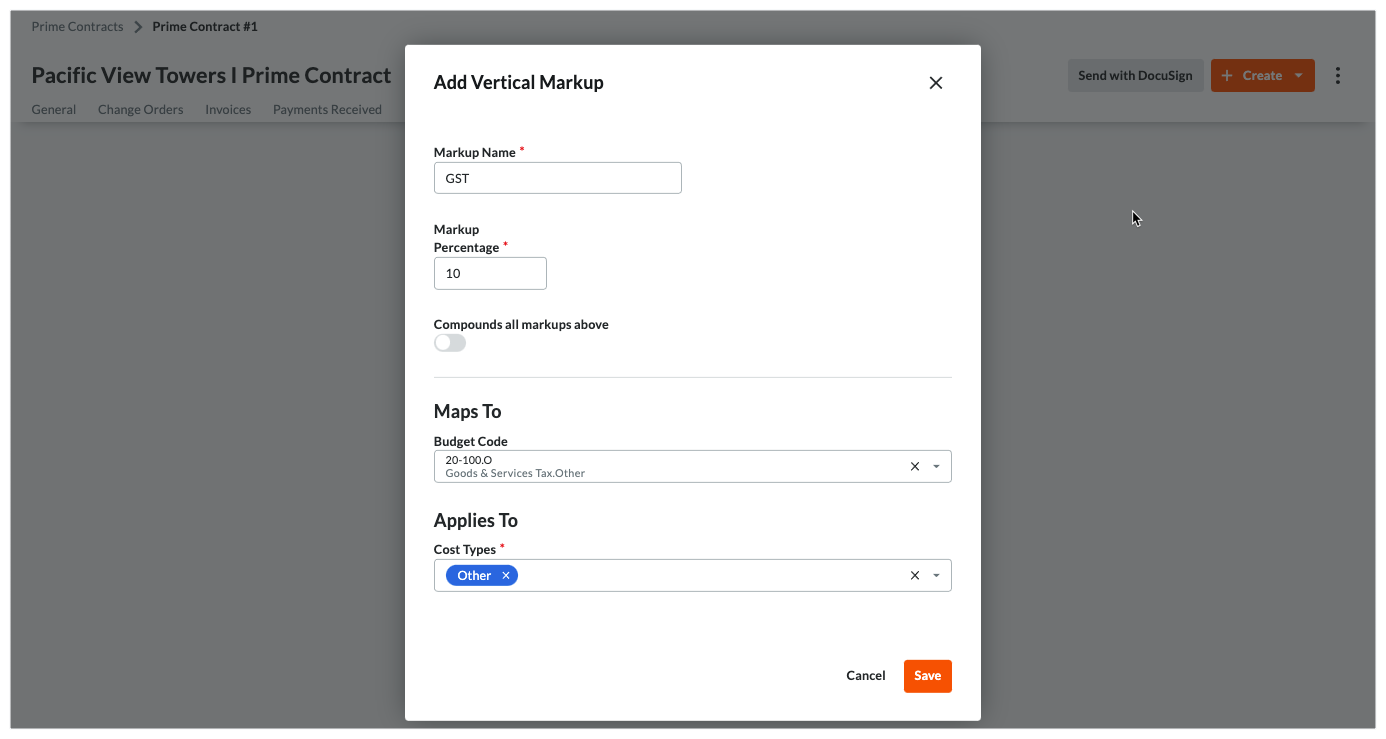

In Australia, the government levies a 10% tax is added to most goods and services, with some exemptions.

In Canada, the government levies 5% is added to taxable goods and services. Some provinces may also levy a separate Provincial State Tax (PST) on goods and services and/or combine the GST and PST into a single Harmonized Sales Tax (HST).

To determine your country's specific tax requirements, always consult your government tax authority.

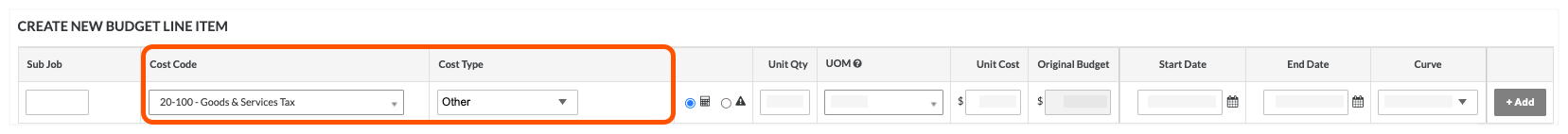

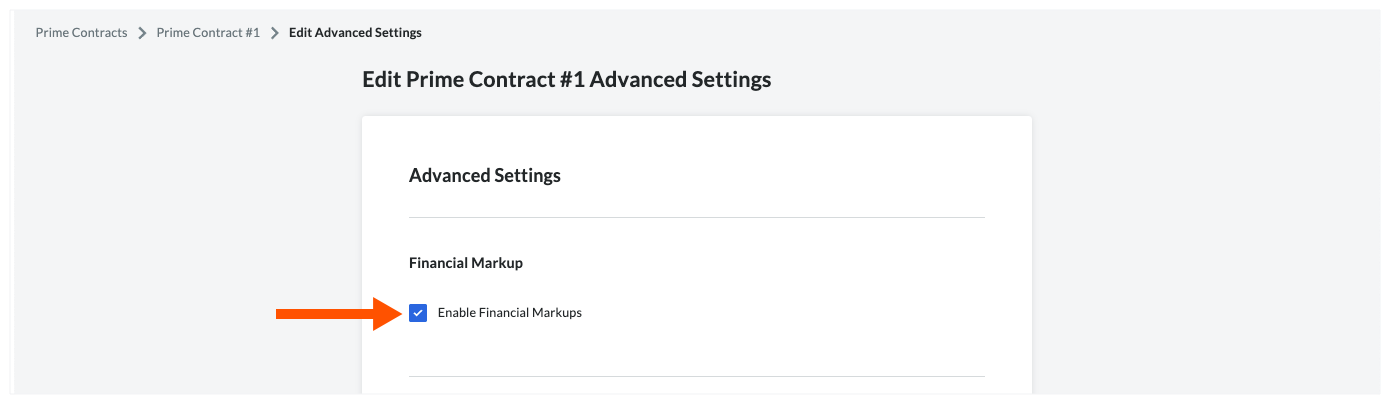

Si vous travaillez dans un pays qui exige que votre entreprise collecte et verse cette taxe au gouvernement, l’administrateur Procore de votre entreprise peut créer un code de coût dédié dans l’outil Admin de l’entreprise, au niveau entreprise et projet. Votre administrateur peut également choisir d’utiliser le type de coût « Autre » (ou de créer un type de coût personnalisé à associer au code de coût de la taxe TPS). Les utilisateurs du projet peuvent ensuite ajouter des postes financiers avec une marge financière à associer au code de coût (et au type de coût choisi), de sorte qu’un poste de TPS s’affiche sur les demandes de paiement (aussi appelées plannings de réclamation) et les demandes d’acompte (aussi appelées factures fiscales) du projet.